Understanding a marriage contract Ontario helps you secure your finances about your marriage.

Key Factors You Need To Need a Prenup Agreement Prior To Getting In a Marriage Contract

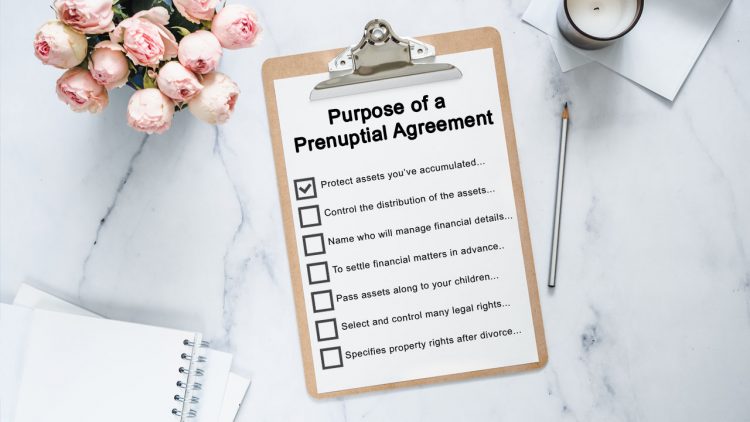

Comprehending the Essentials of a Prenuptial Agreement

While lots of view it as unromantic, a prenuptial agreement, or 'prenup', serves as a practical device in the world of marital planning. Despite its rather cynical facility, a prenuptial agreement can significantly alleviate the stress and anxiety and unpredictability that commonly go along with divorce process, using a sense of safety and security and control to both parties entailed.

Guarding Private Assets and Financial Debts

To protect individual properties and financial obligations in a marriage, a prenuptial arrangement verifies to be an important tool. It permits each celebration to specify which possessions they would maintain as their very own in case of a divorce, thus protecting individual monetary stability. Real estate buildings, investments, or antiques specified as different property in the contract are secured from division. Furthermore, a prenuptial arrangement is vital in shielding one from the other's financial obligations. This suggests if a spouse has considerable responsibilities before marriage, the various other event won't end up being accountable for these financial debts upon divorce. Thus, a prenuptial contract gives a safety net, making sure economic implications of a potential breakup do not unfairly downside either event.

Security for Entrepreneur

For numerous entrepreneur, a prenuptial agreement can be a crucial safety action. It safeguards organizations from being split or offered in the event of a divorce. Whether it's a flourishing venture or an encouraging start-up, the owner's share remains undamaged. This security prolongs beyond the proprietor to partners and shareholders, protecting against disturbance in service operations. Also if one partner bought business throughout marriage, a well-crafted prenup can ascertain that the business isn't taken into consideration marital residential or commercial property. It additionally makes sure that the non-owner spouse is rather compensated without compromising the organization's stability. A prenuptial contract is i was reading this not just a contract in between future spouses; it can be seen as an insurance coverage policy for the organization.

How Prenups Protect Future Inheritance and Estate Plans

In the world of future inheritance and estate strategies, prenuptial agreements function as an essential protect. They use a reliable way to safeguard not just the existing assets of a private however additionally those that will certainly be acquired in the future, including prospective inheritances. These arrangements can clearly stipulate that certain possessions, like an inheritance, must not be identified as marriage residential or commercial property. In the event of a divorce, these assets would remain entirely with the private named in the inheritance. Additionally, prenups can assist make sure that estate strategies are carried out as planned, giving a layer of protection versus possible disagreements. Hence, prenuptial arrangements play an essential function in protecting future wealth and ensuring a person's this economic security.

Ensuring Family Members Assets and Interests

While prenuptial arrangements are commonly deemed a means to shield private wealth, they likewise serve an essential function in ensuring family members assets and passions. These contracts can shield family-owned services, heirlooms, or estates from ending up being entangled in a prospective divorce negotiation. They are instrumental in protecting properties for children from previous marital relationships, guaranteeing that their inheritance legal rights are promoted in spite of any type of subsequent marriage unions. Furthermore, prenuptial agreements can secure family members gifts or inheritances received throughout the marital relationship. Thus, the inclusion of a prenuptial contract in a marriage contract can serve as a protective shield, maintaining the stability and protection of family members possessions and rate of interests for future generations.

The Duty of a Prenup in Clarifying Financial Obligations

Beyond securing family members assets, prenuptial contracts play a crucial duty in delineating monetary obligations within a marital relationship. In the unfavorable event of divorce, a prenup can avoid bitter wrangling over financial obligations and properties, as it plainly demarcates what belongs to whom. Hence, by clarifying financial obligations, a prenuptial contract promotes openness and trust fund, 2 keystones of a solid marriage partnership.

Conclusion

Finally, a prenuptial agreement serves as a protective shield for individual assets, company interests, and future inheritances before entering a marriage contract. It creates a clear economic ambience, lowering possible problems and securing household riches for future generations. Additionally, it plays a vital function Clicking Here in defining financial responsibilities, advertising healthy and balanced interaction, and guaranteeing stability also when encountered with unanticipated scenarios.